tax incentives for electric cars uk

Additionally those earning less than 4189 can save 12 in National Insurance or 2 a month if earning above this threshold. The UK government has cut grants for electric vehicles for the second time in a year provoking the anger of the car industry and prompting a call for car tax to be redesigned.

Pin By Innervisions Id Branding Consu On Tech Co Software Update Electric Cars Tesla Car

Aside from the electric car tax benefits outlined above.

. So the charge was 2792. Therefore this will cease to apply for higher priced vehicles. However how does this compare to other countries in Europe.

This is in contrast to cars with emissions of 51-110gkm or above 110gkm on which you can only claim writing down allowances. Other electric car tax benefits. For 2019-20 low emission cars up to 50gkm are taxed at 16 of list price or 20 for diesels.

There is also an additional charge placed on particularly pricey cars that arent EVs. Electric vehicles qualify for the Salary Sacrifice scheme the scheme allows employees to. Government grants as well as reductions in tax costs aim to make electric motoring more affordable.

Tax incentives from the UK Government for using electric cars Tax on Benefits in Kind BiK. Electric Car Tax Benefits in kind cost to company. There are many incentives for buying an electric car in the UK including plug-in grants for low emission vehicles zero or reduced road tax bills and accessible on-the-go electric charge points across UK road networks.

Tax for electric vehicles. These vehicles have no CO2 emissions and can travel at. For bigger vans the cap is 5000.

This will mean the funding will last longer and be available to. Plug-in electric vehicles emitting less than 50gkm of CO2 have their company car tax set at only 9 for 2017-18. Nowadays buyers of small electric vans under 25 tonnes get a maximum grant of 35 of the list price capped at 2500.

This means that electric vehicles will be more expensive to purchase for the consumer. Speaking to Expresscouk he said. Fully-electric vehicles costing less than 40000 are exempt from the annual road tax.

Finally if used as company cars electric vehicles and vehicles emitting less than 60g CO2km do not pay tax. Grants for EV purchase. 20 of the cost of an electric taxi up to a max.

The UK governments Plug-In Car Grant PICG currently offers 2500 off the cost of an electric car but only for vehicles costing less than 35000. If your hybrid cost more than 40000 then a supplement of 335 will apply from years 2-5 of your road tax payments. From today 18 March 2021 the government will provide grants of up to 2500 for electric vehicles on cars priced under 35000.

More details Company car tax. However there have been significant reductions in this charge from April 2020 with electric-only cars falling to 0 in 2020-21 as well as reductions for electric hybrids depending on their electric-only range. For a plug-in hybrid electric vehicle PHEV the incentive is 2500.

This funding is available for models costing up to 32000. There are further financial incentives associated with driving an electric vehicle. This grant is administered by OZEV.

In the UK the government recently reduced their maximum EV purchase grant to 2500 down 500 from the previous year and made it only available on cars costing up to 35000. 13 in 2018-19 and 16 in 2019-20. Of 20000 for first 200 orders after that up to a max.

An additional incentive scheme allocates 4000 for switching a diesel vehicle of 11 years or more for a new battery electric vehicle BEV. The grant will pay for 35 of the purchase price for these vehicles up to a maximum of 500. The Plug-In Car Van Truck Grant.

A further incentive to investing in an e-vehicle is the road tax payable Vehicle Excise Duty VED. Putting it into context a 20 standard rate tax payer will save 20 in tax for every 100 of monthly lease with 40 tax payers saving 40. CAR TAX incentives for some electric cars should be stopped as it could cause drivers to rebel according to an expert.

Company Car Tax Benefit in Kind From 6th April 2021 both new and existing Tesla cars are eligible for a 1 percent BiK rate for the 202122 tax year. Motorbikes and mopeds also qualify and the OZEV grant will pay 35 of the purchase price so long as it retails for less than 10000. The scheme helps save employees between 30 and 60 percent.

Plug-in hybrid electric vehicles PHEVs have reduced rates but some VED is payable depending on emissions. The rates for all 100 electric vehicles are now 0 and this will apply until at least 2025. Not paying tax on electric vehicles is essentially a Government incentive.

The average petrol or diesel vehicle has a BiK rate of 20 to 37 percent. Up to 150 for mopeds or 500 for motorbikes. Thats after you pay the VED itself so going for a costly car may be an expensive option in the long run too.

Effective from 6th April 2020 fully electric cars will be zero BiK for 202021 1 for. The BiK rate will rise to 2 percent in 202223 being held at 2 for 202324 202425. Percentage used in tax benefits of electric cars registered after 6th April 2020 Electric vans The taxable benefit for having the private use of a zero-emission van was reduced to zero in April 2021.

1448 Fri Jan. 20 of the cost of a large electric van or truck up to a max. The Electric Car Scheme is a high-demand new staff benefit which is a UK Government tax incentive and works via a salary sacrifice scheme.

In 2020-21 the electric van was taxed at 80 of the benefit for a normal van which was 3490. By Luke Chillingsworth 1447 Fri Jan 21 2022 UPDATED. Drivers who find themselves requiring access to the London Congestion Charge Zone in an electric vehicle can save 1500 per day.

Electric Car Market Share Financial Incentives Country Comparison Incentive Financial Share Market

Uk Ev Incentives And Support Progressive Thinking By Conservative Government

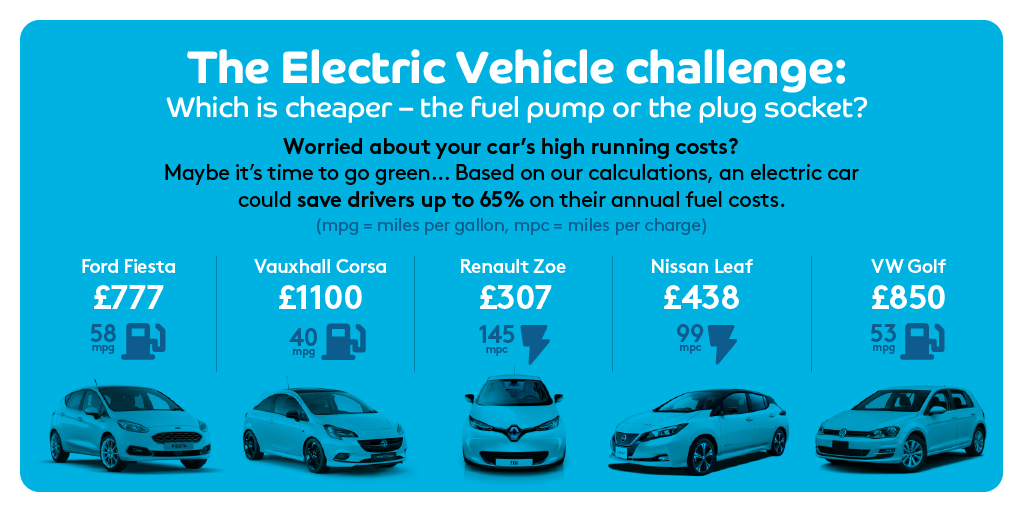

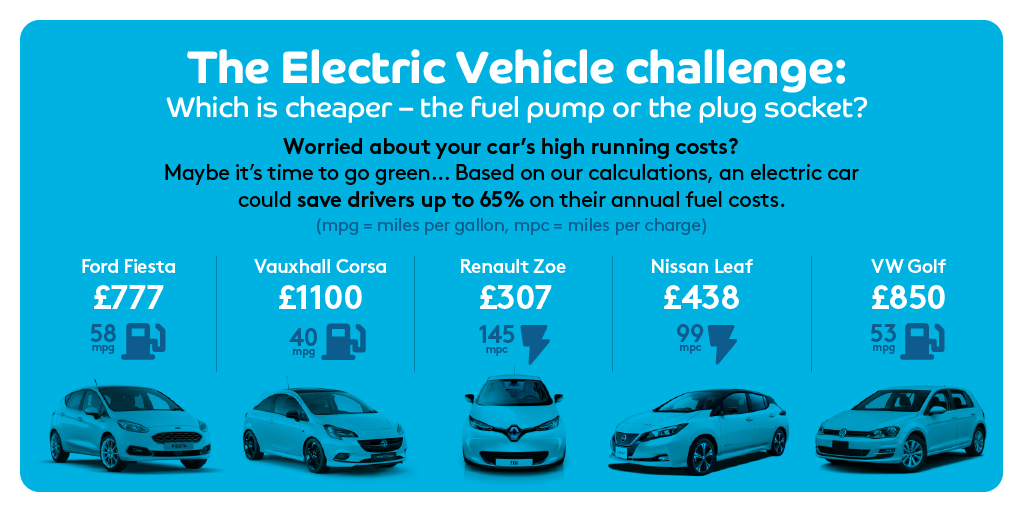

Electric Vehicles Challenges Electric Cars Electricity Cost

Iea Global Electric Vehicle Stats Sales And Outlook Graphics Galore Electricity Electric Cars International Energy Agency

Cost To Charge An Electric Car How It Affects Your Electric Bill

Here S Everything You May Want To Know About Umweltbonus Genannt Purchase Premium For E Cars The So Called Env Electric Cars Incentive Used Electric Cars

Thinking Of Buying An Electric Car Here S What You Need To Know About Models Costs And Rebates Electric Vehicles The Guardian

The Benefits Of Electric Cars A Guide Octopus Group

Review Audi A 3 E Tron E Tron Audi Tron

The Tax Benefits Of Electric Vehicles Saffery Champness

Ev Tax Credit Plan Draws Ire From Non Union Toyota Tesla Bloomberg

Classic British Roadster With Notoriously Bad Electrics Gets Turned Into An Ev Automobile Roadsters Cars Uk Classic Cars

Electric Vehicles Grants And Tax Benefits For Small Businesses Sage Advice United Kingdom

Need To Lower Carbon Dioxide Emissions To Augment The Electric Car Market Growth Electric Car Marketing Electricity